Navigating iXBRL Tagging – Challenges and Solutions for South African Enterprises

The CIPC’s iXBRL Mandate: Friend or Foe for Your Business?

Navigating the complex waters of financial compliance, South African businesses face the pivotal question: Is the Companies and Intellectual Property Commission’s (CIPC) mandate on Inline eXtensible Business Reporting Language (iXBRL) a stepping stone towards efficiency or an added hurdle in their operational race?

The mandatory filing of Annual Financial Statements (AFS) with the CIPC is not just a regulatory checkpoint but a critical reflection of a business’s financial health and compliance status.

iXBRL is an innovative digital reporting format that is fundamentally transforming the processes of financial information submission, analysis, and dissemination. With the intention of bridging the divide between human and machine readability, iXBRL Tagging enables financial reporting to be conducted in a more streamlined, precise, and effective manner.

By employing this innovative methodology, financial data will be seamlessly incorporated into regulatory frameworks, thereby augmenting transparency and facilitating informed decision-making. However, the adoption of iXBRL filing presents a unique array of obstacles and intricacies.

In the process of deconstructing the intricacies of iXBRL’s influence on financial reporting, our objective is to illuminate its capacity to streamline compliance, the challenges that enterprises encounter during its adoption, and the potential remedies that could alleviate the burden of iXBRL filing for South African enterprises.

Understanding Your iXBRL Filing Requirements

The shift to Inline eXtensible Business Reporting Language (iXBRL) filing has marked a significant transition in how companies in South Africa report their financials to the Companies and Intellectual Property Commission (CIPC) as per IFRS Taxonomy and GRAP Taxonomy requirements. The mandate encompasses a broad spectrum of entities, from large corporations to small cooperatives, each bound by the need for transparency and accountability in financial reporting. Here, we delineate who is required to file in iXBRL format and provide clarity on the Public Interest Score (PI score) and its implications.

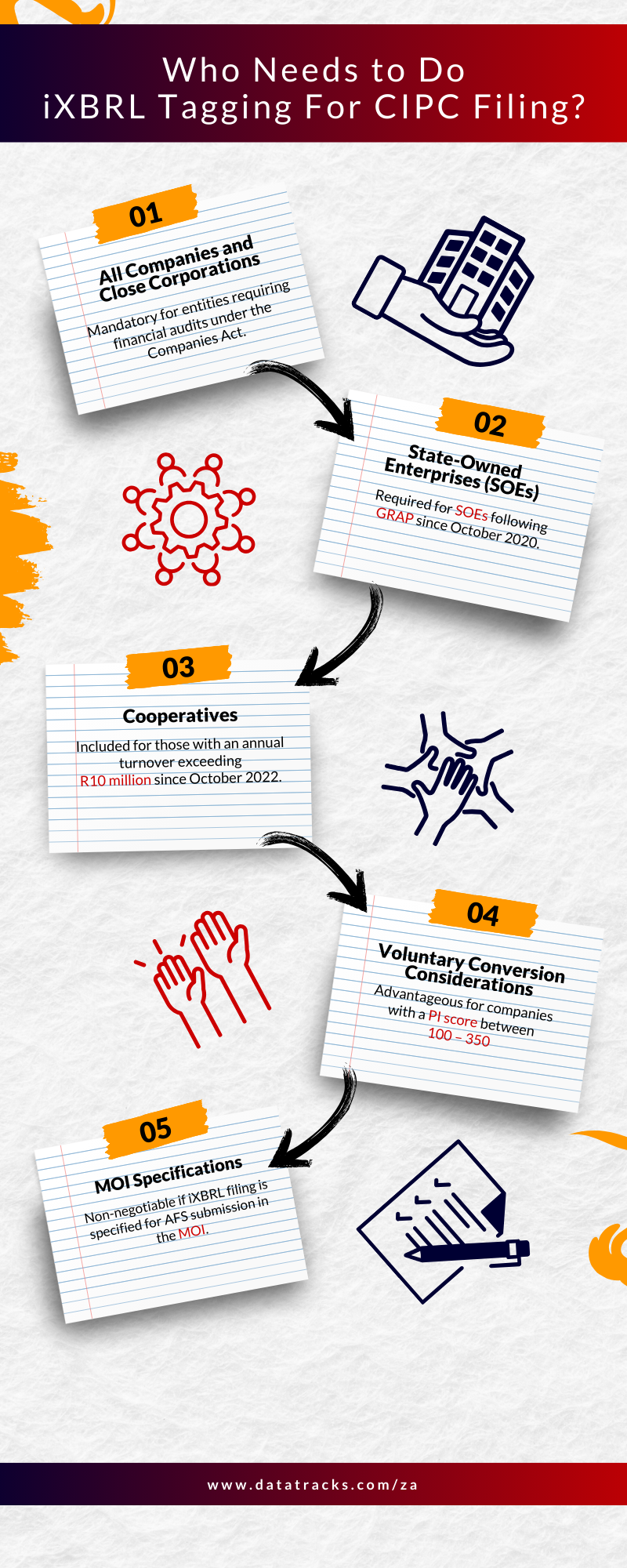

Who Needs to do iXBRL Tagging?

All Companies and Close Corporations

Whether you operate a private, public, or personal liability company, if your financial audits are a requirement under the Companies Act or relevant regulations, iXBRL filing is your lane. This inclusive category ensures that a wide array of business entities contribute to the structured digital financial ecosystem.

State-Owned Enterprises (SOEs)

For SOEs adhering to Generally Recognized Accounting Practice (GRAP) standards, the move to iXBRL has been in place since October 2020. This transition underscores the government’s commitment to enhancing the quality and accessibility of financial data.

Cooperatives

With the threshold set at an annual turnover exceeding R10 million, cooperatives have also been brought into the fold since October 2022. This inclusion reflects the evolving nature of financial reporting obligations, extending the reach of iXBRL filing to a broader economic spectrum.

Voluntary Conversion Considerations

- High PI Score: The Public Interest Score (PI score) is a pivotal metric used by the CIPC to gauge a company’s impact on the public interest. Should your company surpass a specific PI score threshold, typically between 100 – 350, you’re not just eligible but might find it advantageous to voluntarily adopt iXBRL for filing your Annual Financial Statements (AFS).

- Memorandum of Incorporation (MOI) Specifications: For some entities, the decision to file in iXBRL format is already made clear in the company’s Memorandum of Incorporation (MOI). If iXBRL filing is mentioned as a requirement for AFS submission in your MOI, compliance is non-negotiable.

Demystifying the Public Interest Score (PI Score)

The PI score is more than just a number; it’s a reflection of your company’s footprint in the economic and social fabric. While the specifics of calculating your PI score involve assessing factors like turnover, number of employees, and level of debt, the overarching principle is to quantify the extent of your company’s public accountability and interest.

Understanding your PI score is about more than compliance—it’s about your company’s function in the economy. By submitting your AFS in iXBRL format for CIPC filing, your business meets regulatory standards and embraces financial reporting transparency, efficiency, and responsibility. This foresight prepares you for smoother regulatory interactions and boosts your credibility with investors, partners, and the public.

Conquering the iXBRL Tagging and Conversion Challenges

Transitioning to Inline eXtensible Business Reporting Language (iXBRL) filing can be daunting for South African businesses. The intricate process of converting financial statements into iXBRL format presents several challenges, from time-consuming manual conversions to the heightened risk of inaccuracies.

Moreover, the lack of internal expertise in iXBRL can exacerbate these difficulties, making the compliance journey seem like an uphill battle. However, understanding these pain points paves the way for effective solutions, ensuring a smoother transition to iXBRL filing.

Understanding the iXBRL Tagging Challenges

- Time-Consuming Manual Conversion: The meticulous process of manually converting financial data into iXBRL format can be incredibly time-intensive, diverting resources from other critical business operations.

- Potential for Errors: Manual data entry and conversion are inherently prone to errors, which can complicate compliance efforts and lead to inaccuracies in filed reports.

- Lack of Internal Expertise: Many businesses may not have in-house experts familiar with iXBRL, further complicating the conversion and filing process.

Navigating Through iXBRL Tagging Solutions

Leverage Conversion Software

One effective approach to mitigating these challenges is to utilize iXBRL conversion software, an option increasingly being adopted by auditing firms to enhance their services.

These platforms automate much of the conversion process, reducing the time and potential for errors associated with manual entry. While there may be costs involved, the investment can significantly streamline your reporting process, ensuring compliance and efficiency.

Auditing firms, in recognizing the benefits of such technologies, are integrating iXBRL software into their workflows, providing added value to their clients. It’s important for businesses to evaluate different software options to find one that suits their needs and budget, potentially considering those used by their auditing partners to ensure compatibility and streamline the financial reporting process.

DataTracks Rainbow offers a comprehensive solution. This iXBRL tagging software streamlines the conversion process, addressing one of the primary pain points: ensuring data accuracy during the mapping and tagging process. DataTracks Rainbow is designed to simplify adherence to specific taxonomy requirements (GRAP Taxanomy and IFRS Taxanomy) and facilitate the validation of iXBRL documents for compliance, making it a valuable tool for businesses aiming to maintain the integrity and accuracy of their financial reports.

Outsource to a Service Provider

Outsourcing the iXBRL instance preparation to specialized service providers is another viable solution. These experts bring a wealth of experience and knowledge to the table, ensuring your financial statements are accurately converted and compliant with CIPC requirements.

While outsourcing involves additional costs, the benefits of leveraging professional expertise often outweigh the expenses, particularly for businesses lacking in-house iXBRL expertise.

DataTracks’s exceptional iXBRL services are grounded in a deep understanding of the regulatory requirements and challenges associated with iXBRL conversion.

Common Challenges in Converting PDF, Word, Excel to iXBRL

When converting financial statements in PDF or Word or Excel to iXBRL format, businesses frequently encounter several challenges:

Ensuring Data Accuracy: The mapping and tagging process must be meticulously managed to maintain the integrity of the financial data.

Adhering to Taxonomy Requirements: iXBRL documents must comply with specific taxonomy standards, necessitating a comprehensive understanding of these requirements.

Validating for Compliance: The final iXBRL document must undergo a validation process to ensure it meets all regulatory standards.

Formatting issues: This often arise, affecting the document’s readability and professional appearance. Discrepancies in alignment, font styles, and overall layout can detract from the document’s integrity and compliance.

Accuracy is Paramount in iXBRL Tagging & Conversion

Regardless of the chosen method for iXBRL conversion, accuracy remains the cornerstone of successful filing. Inaccurate or incomplete filings not only risk CIPC rejections but can also damage a company’s credibility and financial standing. Investing in the right tools, resources, or partnerships is essential to ensuring that your financial statements are correctly prepared and presented in iXBRL format.

DataTracks South Africa addresses these formatting challenges head-on with its advanced roll-forward feature for quick iXBRL preparations. The dedicated in-house team at DataTracks is specifically trained to resolve such issues, ensuring that the iXBRL documents accurately reflect the original PDFs in design and format. Leveraging DataTracks’ expertise enables businesses to overcome the complexities of formatting, ensuring that financial reports are not only compliant but also preserve the intended presentation aesthetics.

By addressing the challenges head-on and exploring available solutions, South African businesses can conquer the iXBRL conversion challenge, paving the way for seamless regulatory compliance and enhanced financial transparency.

Unveils the Benefits of iXBRL Tagging

While the shift towards Inline eXtensible Business Reporting Language (iXBRL) predominantly frames a narrative of regulatory compliance for South African businesses, the broader canvas reveals a spectrum of advantages extending well beyond mere conformity.

This transformative reporting format not only streamlines the financial disclosure process but also unlocks significant value in data analysis, accessibility, and stakeholder engagement.

We explore how iXBRL serves as a powerful tool for companies looking to leverage financial data for strategic advantages, thereby transcending its role from a compliance requirement to a catalyst for business growth.

Enhancing Data Analysis and Accessibility

Data at Your Fingertips

iXBRL ushers in a new era where financial data transcends being mere static figures on a page and transforms into dynamic, interactive information. Companies now have the ability to thoroughly examine their financial narratives, utilising data that can be easily analysed, parsed, and compared.

This accessibility revolutionises the way businesses perceive their financial well-being, compare themselves to rivals, and spot patterns or chances for enhancement.

Streamlined Reporting and Decision-Making

The standardization of financial data through iXBRL simplifies internal reporting processes, making it easier for management to consolidate, review, and act on financial insights. Decision-making becomes more informed, backed by data that’s readily available and analyzable.

This efficiency not only saves time but also reduces the likelihood of errors, ensuring that strategic decisions are based on accurate and comprehensive financial data.

Attracting Investors and Stakeholders

Enhanced Transparency and Trust

In today’s investment landscape, transparency is not only appreciated, but it is also expected. The standardised reporting format of iXBRL provides a high level of transparency, which helps to establish trust with both current and potential investors.

Through the provision of easily accessible, meticulously labelled financial data, companies can effectively convey their financial well-being and strategic trajectory, thereby cultivating more robust investor relationships.Understanding.

Easier Data Sharing and Comparability

For investors and stakeholders, the convenience of effortlessly exchanging, contrasting, and evaluating financial data is priceless. Financial statements become universally accessible and comparable across different platforms and tools thanks to iXBRL.

With the ability to easily share data, a wider range of investors can be reached and analysts and stakeholders can more easily evaluate a company’s financial position.

Conclusion: A Smooth iXBRL Filing Journey

Undertaking the iXBRL filing process highlights the significance of comprehending intricate filing prerequisites and successfully manoeuvring through the conversion obstacles with accuracy and proficiency.

For South African businesses, the use of iXBRL goes beyond mere compliance. It brings about advantages that improve data analysis, accessibility, and stakeholder trust. By utilising tools that simplify the iXBRL conversion process, companies can guarantee precise, effective, and compliant financial reporting, enabling well-informed decision-making and strategic expansion.

DataTracks SouthAfrica is a reliable source of assistance, providing specialised iXBRL solutions that cater to the specific requirements of businesses dealing with the intricacies of iXBRL filing. Equipped with cutting-edge software and expert services, DataTracks can help your business smoothly transition to iXBRL, ensuring a successful outcome. Embrace the future of financial reporting with DataTracks, and transform the iXBRL filing mandate into a chance for exceptional business insight and expansion.