Your journey to seamless VAT reporting starts right here.

DataTracks’ Oxbow makes it easy, reliable and future proof.

DataTracks’Oxbow MTD for VAT Bridging Software

DataTracks’ Oxbow

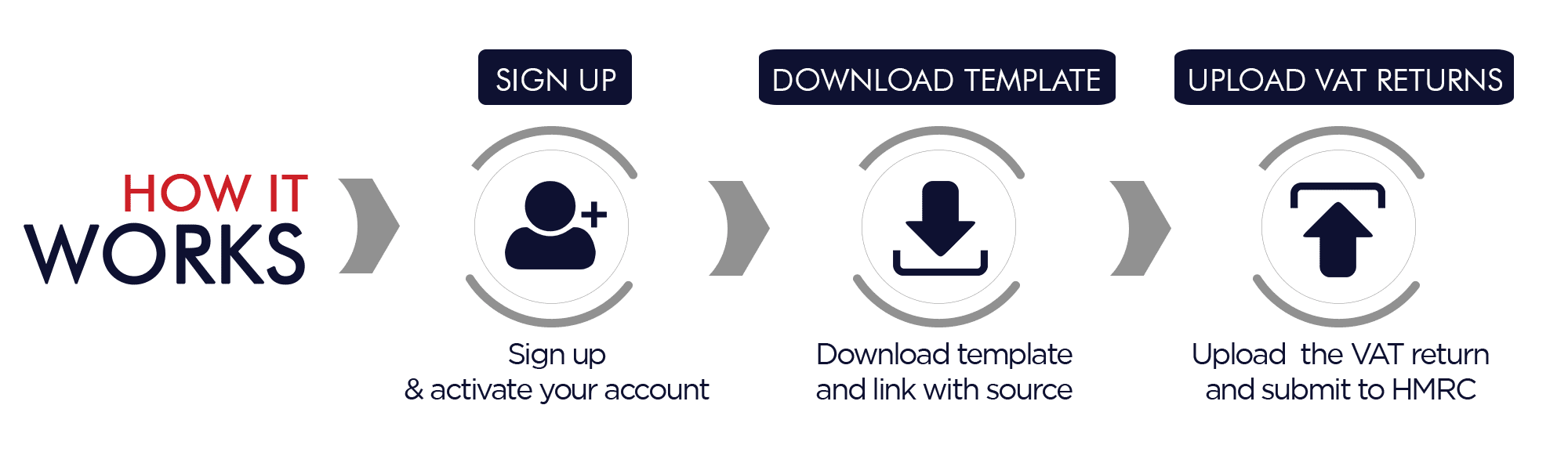

DataTracks, a software provider recognised by HMRC for supporting Making Tax Digital (MTD) for VAT, enables a seamless and smooth VAT filing with HMRC. In alignment with HMRC’s digitisation process, the company’s team of experts has developed an effortless bridging technology that links the regulator’s APIs to collect data and facilitate VAT filing.

The MTD solution provided by DataTracks is suitable for all levels of businesses and agencies. It allows people to keep using Excel spreadsheets to store their data and then to file their VAT returns with HMRC while meeting all the requirements of MTD.

Why choose us?

DataTracks’ has been working with HMRC for over three years to make certain you’re supported through this transition to digital tax with Making Tax Digital software.

After conducting several pilots and gathering comments from accountants and businesses, we’ve built our software that ensures you to fulfil your Making Tax Digital obligations.

HOW WE BRING VALUE TO YOUR BUSINESS

CONTACT US